Asking the Thousand Dollar Question: Students struggle to pay for college with increasing nationwide tuition

With graduation right around the corner, college is on the mind of all the high school seniors. While grappling with their choices that they will inevitably have to make, there is a real world road block on the path to their choices: money.

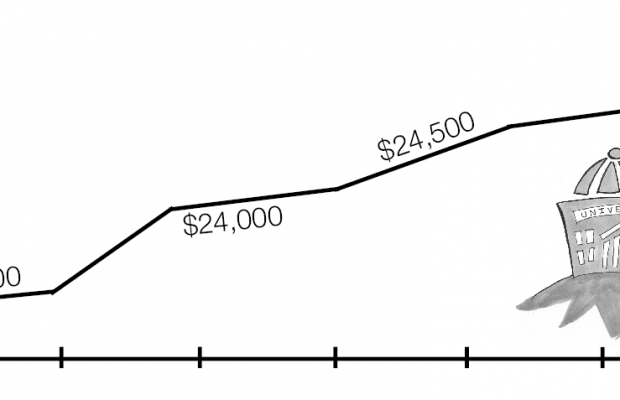

The increasing tuitions nationwide is something that cannot be ignored. Over the past two decades, tuition has increased on average for all institutions by $866 yearly, when inflation has been adjusted. Public and private institutions alike have raised their tuition so much that over time, their affordability has become a real deterrent for people seeking a college degree.

According to the Center on Budget and Policy Priorities, as well as the Economic Policy Institute, the costs of tuition including room and board has increased 10 times as much as median family income over the past two decades. Furthermore, the power of a bachelor degree is increasingly devalued due to an oversaturation of college degrees in the job market. In the words of finance writer James Altucher, “college graduates hire only college graduates, creating a closed system that permits schools to charge exorbitant prices and forces students to take on crippling debt.” The substantial hikes in cost of attendance to earn a bachelor degree make a college education unaffordable and untenable for many across the United States.

With an obvious problem glaring young Americans in the face, there is a solution. To start, a substantial resolution for students requiring aid is the Free Application for Federal Student Aid (FAFSA). The FAFSA is the premier spot for incoming college students to receive federal aid in their post secondary education. Students every year neglect to fill out the form at a loss of about $2.7 billion in federal grant money in 2016 alone. Although not everyone qualifies for student aid, there is no reason not to fill out the FAFSA. Similar to the FAFSA, non-federal need-based financial aid can also be applied through the College Board’s CSS PROFILE. Other need-based financial aid can come in the form of scholarships and work-study programs, a part-time job for students to help finance their education through the university.

Other than aid determined based solely off of need, another option is the multitude of scholarships and grants available to students of all academic focuses and cultural backgrounds. These scholarships can be local or national. It is important to thoroughly search for scholarship through both the Internet and the College and Career Center. Even services like the Common Application and the University of California Application include options to search and apply for scholarships. However, most scholarships are scattered around the Internet, making it impossible to track down every opportunity that is available.

No conversation about student debt can be complete without addressing student loans. In 2012, Pew Research Center found that 69% of students had taken out loans to pay for education. If you need to get a student loan, understand all your options, both federal and private, and choose a payment plan that works for you.

College is increasingly expensive; therefore, no one should discount junior or community colleges and transferring to a four-year university after two years. Not only does this option allow you to earn a bachelor degree, but also it is much more affordable than going directly to a four-year university according to 2016 numbers from the American Association of Community Colleges.

While money is an integral factor in considering a college decision, do not forget to consider how you fit in on campus along with its location, culture, size, and even just the vibe you get when you visit. Graduating high school is the jumping off point into the start of your adult life. Let college be your first step in the right direction.