Thousand Oaks residents discuss healthcare

Introduction:

According to the New York State Department of Health, many countries similar in development to the United States provide health coverage to almost 100 percent of their citizens. In contrast, the U.S.’ Medicare, or insurance for people aged 65 and older, and Medicaid, insurance for low income individuals, together insure 37.5 percent of the population. To cover the costs of routine medical visits and procedures as well as unexpected hospital visits, a majority of U.S. citizens rely on health insurance companies. For those that do not have health insurance or have plans with high deductibles, unexpected medical fees can leave them in crippling debt. Every insurance company differs in the plans they offer, the coverage those plans provide and their provider networks. Correspondingly, medical professionals and hospitals make decisions to take certain health insurance plans over others. Regardless of the specific numbers, when a person is in need of healthcare, they will be paying for it in some way, often through their work or out of pocket. A majority of citizens in California and in Thousand Oaks rely on insurance plans or a system of financial aid to cover their medical bills.

Insurance:

Access to healthcare for many Thousand Oaks residents means an investment in health insurance. Insurance plans include categories, each offering a different amount of coverage, with some covering almost 100 percent of healthcare costs and others financing only 60 percent. Most insurance companies offer an HMO or a PPO plan that each have their own set of benefits. HMO has a cheaper monthly fee but doesn’t give flexibility on visiting out-of-network care, the exception being emergencies. PPO is a higher fee per month but allows for visits of out of network care without additional fees. Each individual selects an insurance plan that works best for their interests and provides them with the level of care they need. However, at times, the insurance plan a person needs is not the plan they can afford.

For Maricela Ortiz, her insurance plan with Aetna was sufficient to cover the majority of her medical bill costs after having a child in the hospital, despite complications with an unexpected invoice. One of the medical professionals in the OR during her C-section was not in her insurance network, but she was aware. “I [was] not in a position when they’re taking the baby out to make decisions on who participates or not,” Oritz said. After receiving the bill, she fought it and was frustrated with the whole situation. “[It was] very confusing [and] very expensive,” Ortiz said, “I wish I didn’t have to deal with it.”

With the rise in inflation, health insurance costs have directly been affected, and most citizens in the United States are paying anywhere from 300 to 800 dollars a month to get the coverage they need, according to the Kaiser Family Foundation Marketplace Average Benchmark Premiums for 2023. Stephanie Cipriano-Cerniga, an academic specialist at EARTHS Magnet School, experienced this inflation in healthcare first-hand. “I had a C-section with my middle child, and her bill was less than my third child, who I had a natural birth with. I was only at the hospital for a total of 24 hours and [my youngest child’s] bill was almost three times what [my middle child’s] was,” Cipriano-Cerniga said.

Cipriano-Cerniga shared the importance of having steady health insurance: specifically, the value of a PPO plan. “I went through a miscarriage, and that was the tipping point of when we decided to get off of Kaiser and move to a PPO, which is what we have now. Because it was not just physically painful, but emotionally painful, and I would never wish that upon anybody. With an HMO, you’re very limited on who you can see and who takes your insurance. So it was really important to me that we have a PPO,” Cipriano-Cerniga said.

But even for those who are financially secure, health insurance can still pose an issue in communication. In Jonathan Gereige’s experience, the bills that come after receiving care have an ambiguous quality. “It was just a little bit of a black hole. And it was unexpected, because they give you an estimate, they [tell] you what can be covered [and] what’s not covered. And then you actually pay that, whatever is your portion, before you go in. And then a month or two later, you get a bill, and it’s hard to kind of square away,” Gereige said.

Community Involvement:

Alongside the staff of nurses and doctors, NPHS students in the hospital setting are delegated responsibilities, allowing them to work with healthcare professionals, observe them in their field and witness the first-hand effects of the healthcare system on the residents of Thousand Oaks.

Rayna Doshi, junior, has been in Los Robles Hospital’s volunteer program since the end of her sophomore year. “I’m in something called ‘float pool’, where we get calls, [so] we do jobs that the nurses don’t have the time to do. So we’ll go, maybe do a food delivery or do a discharge,” Doshi said. The volunteers ease the workload of the hospital staff, going all around the hospital running errands and interacting with both patients and healthcare professionals.

For Deitel, the volunteer program has provided her hands-on experience in the medical field through her work helping patients in the emergency room. Her respect for Los Robles’ system is attributed to the attentiveness of the healthcare workers to the needs of their patients. “As a volunteer, I know that emergency rooms are known to have super long wait times, but whenever I’m working there, it’s like five minutes, or the longest it’s ever been is 10 minutes; it’s really efficient in helping people if they come in,” Deitel said.

In addition to gaining medical experience, being a part of the program has allowed Sinjini Dutta, junior, and the other volunteers to contribute to the hospital’s quality of care for the community. “I feel like [the volunteer program] facilitates the care and it makes it more focused, because without that many people doing the non-medical stuff, the nurses wouldn’t be able to focus on just taking care of [patients],” Dutta said.

From her volunteering experience, Doshi has gained a newfound respect for the way hospitals are organized and operated. Doshi’s main takeaway from these observations in the hospital environment is the way in which healthcare workers interact with their patients, and the care they show for them, regardless of their financial situation. “I think a lot of people there, and the patients, complain about how disorganized [hospitals are], and how they’re not getting the care they need. But then you realize a lot of the nurses and staff are under-staffed and they’re really doing their best. They’re busy the whole time,” Doshi said.

Health insurance determines the fate of our futures:

Without health insurance my family would be over a million dollars in debt. You read that right. Exactly 1,714,885 dollars in debt in just the last two years. During my freshman year of high school my mom was diagnosed with breast cancer and underwent a double mastectomy, four rounds of chemotherapy and three months of radiation, along with routine check ups and other minor surgeries. A year later, during my sophomore year of high school, my dad was diagnosed with melanoma, a type of skin cancer. He had a removal surgery along with other cancer treatments, and is currently going through a year of immunotherapy and a vaccine trial. What happened came as a complete shock and was unbelievably bad luck. However, we could have been a lot less fortunate. Just months before my mom was diagnosed with cancer, our new insurance from my dad’s new job went into effect. Had he not gotten that job when he did, my family would not have been covered by health insurance and my mom’s surgery and treatment would have been out of pocket. While my family got lucky, many others are not as fortunate. This is the reality of healthcare in the United States.

The last two years of my life have really opened my eyes to how vexing our healthcare system can be. From watching my parents spend hours going back and forth with our insurance company to hearing of the constant medical bills, I have come to the conclusion that the United States medical system cares most about the money, not the patient. I am not saying there is no one in the medical system who cares about their patients; however, insurance companies seem to care more about how much your deductible is as opposed to your health status. I mean, as long as they are making a profit why should they care? Afterall, the basis of our country is capitalism. Who really cares if people are dying due to medical issues they did not choose to live with? Who cares that middle and lower class Americans get stuck in millions of dollars of debt due to not being properly covered by health insurance? As long as there are big bucks filling the pockets of insurance corporations it is seemingly acceptable.

The morality of health insurance companies falls into a gray area in my opinion. While some companies offer more healthcare coverage than others, they often surcharge the plan leaving people in a tough position where they have to choose between good health insurance or being able to pay the bills. Good health care should not be a privilege. It should be a right.

The bottom line is my family’s case in healthcare is not everyone’s experience. Some people have good experiences and some people have bad experiences. Regardless, the system needs to be improved. Being forced to pay hundreds of thousands of dollars for life-saving procedures is utterly ridiculous. Being forced to pay thousands of dollars to give birth in a hospital is outrageous. Being forced to pay for the right to live is heartbreaking. Unless something changes this is what we have to look forward to as adults. This is the reality of our futures.

Conclusion:

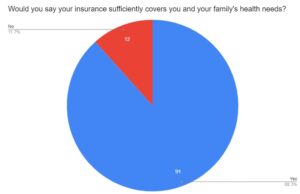

Thousands Oaks citizens believe access to medical care is extremely important and in emergency situations it is vital that they have access to quality care that they can afford. The satisfaction of T.O. residents with their medical care varies, and much can be improved to increase their trust with the system. Unexpected bills and invoices after medical treatment are not a rare occurrence, but rather affect many members of our community. Additionally, the burden of medical bills can be a heavy toll on those who are not in a financial position to pay them in unexpected emergencies. Addressing the shortcomings of health insurance in the United States is a multifaceted issue that requires a complex solution.

Jasmine Zhang/Prowler

Jasmine Zhang/Prowler

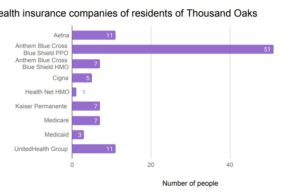

*The Prowler information survey was taken by 103 Thousand Oaks residents.